I occasionally chat with Uni students about financial literacy/ confidence.

I firmly believe that learning to manage your finances is one of the most powerful things you can do in terms of your current and future wellbeing. And I am not alone.

Talking about financial literacy with university students however often ends up in a discussion about financial resources (i.e. how much money students have), which is typically not a lot. Students then question the importance of learning about money if you don’t have much.

And, if I am being honest, I didn’t really start taking financial literacy seriously until I was in my mid thirties. The problem is I WISH I had started considering it earlier.

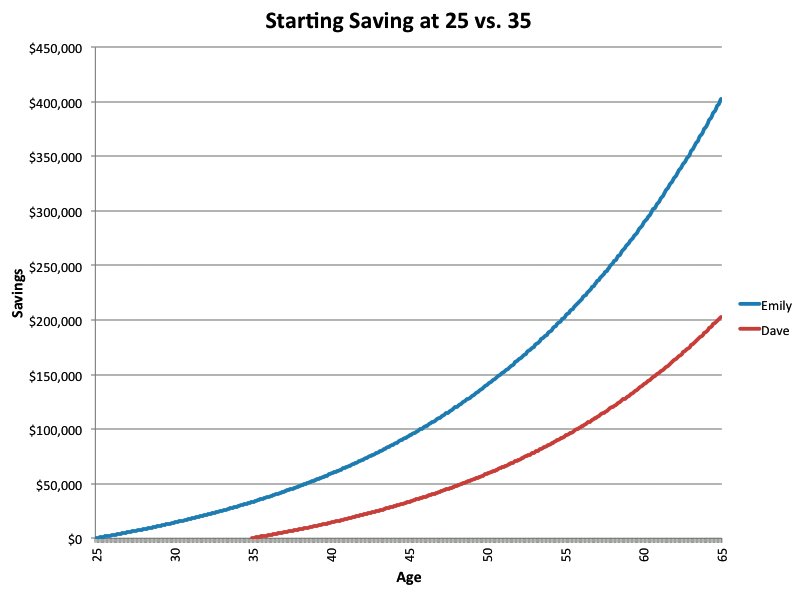

Put simply, the earlier you start learning about how to manage money, the better your long-term outcomes will be. This is because saving and investing work their magic over time, due to compound interest. You’ve probably seen graphs like this one before:

Two people, making equal contributions of $200 per month to an investment/superannuation account earning 6% interest. Emily starts earlier than Dave. At age 65, Emily has almost twice the amount as Dave.

Now I know what you are thinking. If Emily is doing a degree and not working much, she isn’t going to be able to put $200/month aside. And that is a fair argument, but the earlier Emily learns to put some of her income aside, the better off she will be.

You see, learning how to manage money can be done regardless of your level of wealth. For example, learning how to budget and spend less than you earn, is relevant regardless of whether you are earning $100 or $1000 a week.

That brings me to the subject of this post.

I just found out about an interesting opportunity, specifically for university students, to learn more about investing. It is a competition called Australia’s Next Top Trader – https://comp.nexttoptrader.com.au/.

It is being run by the guys who produce the Equity Mates Investing Podcast, in collaboration with Stake (an investment app).

I’m a recent convert to the Equity Mates podcast. It is basically two Australian guys, who met at uni, who have a passion for investing and who like chronicling the investment lessons they are learning as they go. Their podcast is a great (and free) entry point for anyone wanting to learn about investing.

The basics of the competition are this:

- Register your name and email on this page.

- Follow Equity Mates Investing Podcast and subscribe to their show, for all your lessons, tips and insights about investing.

- Sign up for a Stake trading account on their app (IOS and Android) or on their website (hellostake.com). This takes less than 5 minutes if you have your ID on you!

- Fund your account (min $50).

- Get a head start, and refer your friends using your Stake referral code (provided with your account) – you can start earning now! For every referral, you AND your friend will receive $5 trading credit.

- Stay tuned for more updates so you are ready for Opening Bell (11 March 2019).

From the 11th March, you’ll have six (6) weeks to try and increase the value of your account by trading shares, based on the guidance and lessons from the Equity Mates guys. The winner of the competition will be whoever increases the value of their Stake account by the greatest percentage (%). This means you don’t necessarily have to have a lot invested.

The winner gets a trip to visit the New York Stock Exchange – accommodation and flights paid!

I think this is a really neat opportunity, assuming you can raise $50.

Here are the caveats though and they are big ones:

- You should be willing to lose the $50 you have invested. My first investment I lost the lot. So don’t enter this competition with money that you really need.

- You will in the process of entering this competition become a client of Stake, who are an Australian company who make their money helping Australians gain access to trading US shares. Now Stake are a legitimate financial service, but they may not be how you ultimately want to invest (there are other options). Also, their fee structure is set up in a way that encourages you to keep using the platform, but discourages you taking your money out, so there might be a bit of a feeling of being ‘stuck’ in the platform, once you are there. I encourage you to spend some time on their website, reading about what they do, before deciding to create an account with them. If the site doesn’t make sense to you and you don’t understand what they do, DO NOT invest with them. Never invest in something you don’t understand.

- The Equity Mates guys, whilst definitely keen to help people learn about investing, aren’t financial advisors. Their ideas and suggestions might not be appropriate for your financial situation. Again, if you listen to the podcast, and don’t understand what they are talking about, DO NOT follow their advice. Simply keep listening and reading until you understand better what they are talking about.

These caveats in mind, if this sounds interesting, hit the links above to read more.

And regardless of whether you enter the competition, consider adding the Equity Mates to your podcast list. A good way to start your education about investing that is free.