Overview: I’m a psychologist, not a financial advisor, so I don’t talk a lot about money. However, I am mindful that financial control is a powerful predictor of wellbeing. In this post, I encourage you think about how you might start developing good financial habits and where to learn more about such habits. Reading time ~ 12 minutes.

When I hear students talk about money, a dominant theme is usually ‘I don’t have any’.

That makes sense. Studying means reduced opportunities/time for work and earning.

Students are generally living on much tighter budgets than those of us able to work full-time. I certainly didn’t have much money when I was studying.

A psychological by-product of not having much disposable income is that we tend to stay focused on how much money we have ‘now’, rather than thinking about our financial future. However, thinking about our financial future can be beneficial in terms of your spending now, but also your ability to create wealth in the future.

So, I want to encourage students to start thinking about (and maybe making changes) that better secure their financial future. I want students to start taking financial control.

The reason is that financial control is one of the top 3 predictors of wellbeing across the lifespan, along with supportive relationships, and a sense of meaning and purpose.

Now I can hear what you are saying – “What is the point of learning about financial control, if I have no money to control?”

Good question…

Financial control is not the same thing as income. You can have a very high income but poor financial control, and be miserable. Alternately, you can have a relatively low income but a high level of financial control, and be content. It is about being smart and effective with the money you have.

There are three basic reasons why I think the typical university-aged young person (18-22yo) should start educating themselves about money (more mature students – I haven’t forgotten you, keep reading)

1. Being good with money involves developing good ‘habits’. Good habits help you cope under situations of low income, but also allow you to take full advantage of your income when it increases.

2. Learning about money makes you less likely to fall for financial scams that target individuals with low financial literacy.

3. The earlier you get started with saving and investing, the more you can take advantage of compound interest.

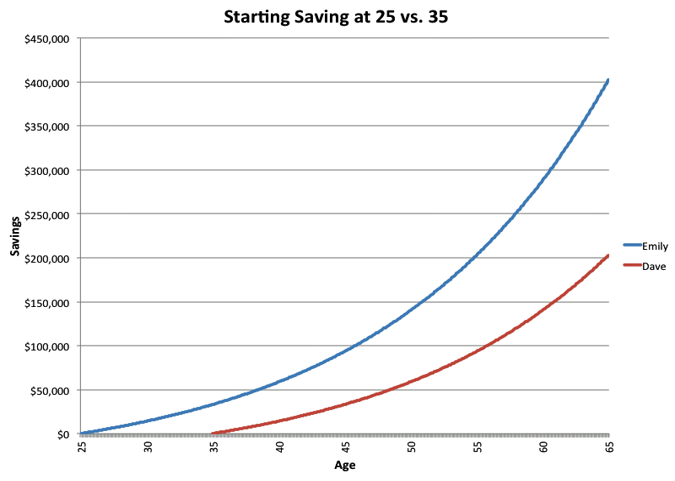

Take this common example you see on financial blogs and news sites, which compares two individuals who start saving at different ages and what their outcome is at retirement age (65).

It shows clearly that the earlier you start saving and investing, the greater the wealth at age 65. What is interesting about this particular example is that Emily only contributed $24,000 more than Dave, but ends up with $199,374 more than him at the same retirement age.

Put simply, whatever investment you can put into your financial knowledge now, will literally pay dividends in the future.

For those of you (like me) no longer in your 20’s, don’t fret. I didn’t really start taking money stuff seriously until my mid 30’s and didn’t have a clear financial plan until recently (40’s). Even if you have a late start, you can do a lot before the retirement age of around 65.

So what are the key financial skills?

First, let’s get an important qualifier out of the way. I am not qualified to give you money advice. I am a psychologist by trade, not a financial advisor.

I have however spent a lot of time over the last few years trying to better understand money, and in doing so have a) identified some of the key financial skills, and b) identified good resources from which to learn about these skills.

My view is that if you can get a decent understanding of the following that you are well on your way to being financially competent.

- Budgeting – There are at least three parts to this. The first involves understanding your income, how much you get and when. The second involves reviewing your expenses over the past month/year so you know where your money is being spent. The third involves making modifications to your lifestyle so that so that income > expenses. This might involve a change in behaviour (e.g. buying less or cheaper), or modifying your expenses (e.g. getting a better deal on electricity). If income > expenses, this then sets you up for the next item.

- Saving – It is fairly self explanatory that if income > expenses then you have some money to save. Even if you can only put aside $5 or $10 a week, it is a habit that is excellent to start as soon as possible. Where possible have savings goals to motivate yourself to keep doing it. It might be for travel, or for a house deposit or for investment. Regardless, setting yourself savings goals and successfully working towards them helps give you a sense of financial control.

- Managing debt – There are ‘good’ types of debt (e.g. mortgage, HELP/HECS) where the asset purchased tends to retain value, or even appreciate in value. A house is a good example. Your education is also a good example, because those skills will help your earn more money. Then there are ‘bad’ types of debt which typically end up in you paying a lot of money because of high interest rates or depreciating assets (e.g payday loans, credit cards). Where possible try to limit debt to the good types. If you are having issues with debt, or bills piling up, connect with FUSA, who have a financial advocacy service.

- Superannuation – Superannuation is an effective vehicle for long-term saving/investment but people often don’t really start thinking about it till their 30’s or 40’s. This is a shame because in addition to being a good investment in the future, superannuation can also be an affordable place to get some kinds of insurance (e.g. death/disablement/income protection). Superannuation has been in the news recently because of the bad behaviour of some of the funds. Also people often neglect their super leading to multiple accounts, or small accounts that are getting eaten up by fees. That is why it is important to spend the time to familiarise yourself with your own superannuation situation. Making extra contributions to your super can be a tax effective method of building savings for the long-term (i.e. retirement).

- Investing – Investing includes things like putting money into real-estate or shares. The topic can be very intimidating if you know nothing about it. However, there are differing investment opportunities depending on your timeframes, risk tolerance level, and preferences (some people like property, I personally like shares). Thanks to apps like Spaceship Voyager or Raiz, there are now investment opportunities even if you have very small amounts of money. Don’t invest in things that you don’t understand. Also be aware that there are many ‘investment opportunities’ that are spruiked that are not good options, some even scams. Start here.

- Insurance – There are many types of insurance: health, home and contents, income protection, car, life. You pay insurance so that, in the event of something bad happening, you are protected, either financially or practically. The types of insurance you need will depend very much on your unique circumstances, so similarly with investing, do your homework. Start here.

- Financial plan – A financial plan combines all the elements above (plus a few others) into a coherent, customised strategy for how you will manage your finances moving forward. Your financial plan will change over the course of your life. The earlier you can get one in place, the more comfortable you can feel knowing what you are working towards. Although this guy is American, I quite like the free financial plan starter document that he provides.

Where to go to start learning about these areas

So each of the topics above could be the subject of multiple posts.

And if you are looking at the above list and feeling a bit overwhelmed, it is perfectly normal.

Your job is to not become an expert straight away, but just to get started reading more about these topics.

Given that I am not a financial advisor, I can’t tell you what to do in any of these areas, but what I can do is tell you where I have learned about them.

The main way I have educated myself financially is through the Barefoot Investor – Scott Pape. I don’t get any royalties or kickbacks from recommending him. I simply think he is one of the most conservative, sensible, independent, and easy to understand financial commentators in Australia. His book is a best seller and readily available. If you can’t afford to buy it, try finding it at the library.

The other really good (and free) place to learn about lots of different finance topics is the Moneysmart website, run by the Australian Securities and Investment Commission. Because they aren’t trying to sell you anything, their advice is uncomplicated and independent.

And of course, as a Flinders student, you have access to financial counselling through FUSA. Win!!

You can’t go wrong starting with these two resources.

Takeaway message

Whilst your time as a student might not be a period of significant wealth accumulation, it can be a period of time in which you start learning valuable financial management skills.

And it doesn’t need to be complex or expensive to do so. You can learn a lot from free or low-cost resources like the two recommended above.

If you feel like you’ve grown up with very few conversations about finances or money, you are not alone. There are high rates of financial illiteracy in Australia and money is a conversation that many parents don’t feel comfortable having with their kids.

You can change that by equipping yourself with the knowledge required to make good financial decisions, now and into the future.